Table of Content

The first is to evaluate the actual value of the property, and the second is to ensure the house meets all the MPRs and is safe for living. If your home costs more than the defined VA limits, you have three options. After getting preapproved, you can move onto the VA loan process and apply for the VA loan Certificate of Eligibility.

You will need this certificate when you approach a VA-approved lender for a home loan. VA Loan Professional is the most valuable and accurate source of custom VA loan information. We'll help you estimate how much you can afford to spend on a home. Please contact our support if you are suspicious of any fraudulent activities or have any questions. If all the information you provide the lender checks out, you will receive a preapproval letter from the lender.

Debt Payments

Here is a mortgage rate table listing current VA loan rates available in the city of Los Angeles and around the local area. But, as discussed, the VA sets some home loan requirements, but it doesn’t actually lend money. In other words, just because you meet VA DTI criteria to borrow $380,000 doesn’t mean your lender will actually approve a loan of that size.

How to secure a VA loan and all of the benefits that go along with it in an easy, step by step guide for active duty... VA loan limits used to be more or less the same as conventional loan limits. However, starting January 1, 2020, those limits have been repealed. Below is a chart of VA funding fees when purchasing or refinancing a home.

Other Homeownership Expenses

By using, you will be matched with participating members of the ICB Solutions network who may contact you with information related to home buying and financing. These members typically have paid to be included but are not endorsed by ICB Solutions, LLC or this site. The interest rate is a percentage of the amount borrowed charged to the borrower. Your ultimate interest rate may differ; rates in the calculator are for informational purposes only. Any borrower with a DTI above 41 percent can still get one, but the process may require more investigation into your finances.

All veterans, active-duty members, and staff of the National Guard and Reserves must follow these rates as of January 1, 2020. Veterans and military members can refinance to a lower rate with favorable terms. This is done through the VA interest rate reduction refinancing loan program. You also have the option to refinance to a fixed-rate loan or an adjustable-rate mortgage.

Debts Exceed Debt to Income Ratio

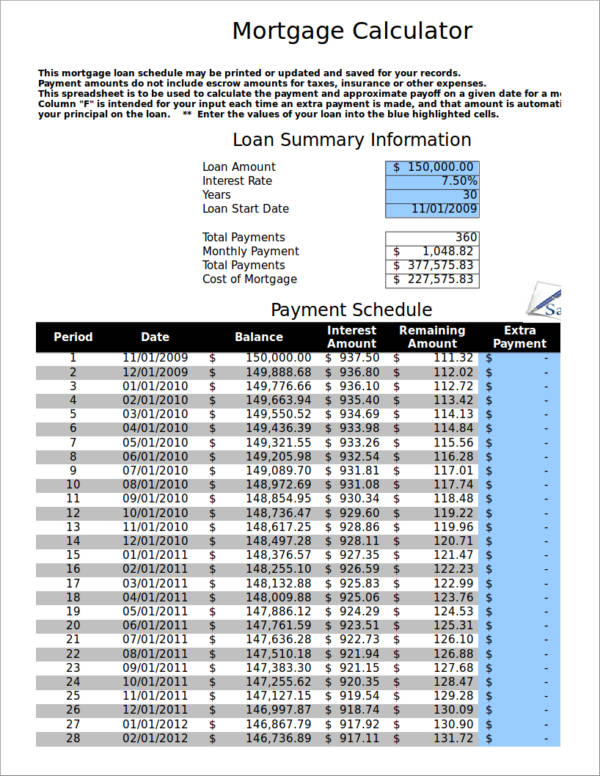

VA mortgage calculatorUse our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families. Lenders require you to insure your home from damages like fire. The fee is generally added to your monthly mortgage payment and paid for you by the lender. A VA funding fee is a one-time payment that borrowers typically pay as part of acquiring a VA loan. It is the fee that goes towards the upkeep of the program and is used in the case that a borrower defaults.

Veterans and active military may qualify for a VA loan, if certain criteria is met. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage. Though VA loans do not require mortgage insurance premium, you must pay a VA funding fee.

Below is a summary of the inputs and calculations used to calculate estimated payments and closing costs. After you calculate the mortgage payment and the loan amount you believe you can afford, give us a call and let us get right to work for you. We’re available 7 days a week to help pre-qualify you for the perfect loan, working on your schedule, not ours.

In some cases, our VA borrowers can properly budget for these higher ratios, particularly those with higher incomes. On the other hand, notice the significant increase in upfront fee with subsequent use. If you make no down payment on a subsequently used VA benefit, the funding fee increases to $7,200. Meanwhile, if you make less than 5 percent down, it decreases your loan amount to $196,840, while your funding fee is reduced to $6,840. The table below compares identical VA loans with different usage status and down payments.

The U.S. Department of Veterans Affairs offers VA loans for servicemembers, veterans, and eligible surviving spouses. VA loans allow you to get a mortgage with no down payment and a low interest rate, plus other benefits. Before you get a VA loan, you need to calculate how much home you can afford.

If you were to buy a house for $836,150 with a VA loan then you would need to cover 25% of the loan amount above the local limit. Related to emergency funds, taking out a smaller mortgage than you can currently afford provides you a financial buffer. We have kids, spouses lose jobs, we separate from the military , someone gets sick, or any other number of scenarios. That is, you don’t have to borrow your maximum VA loan amount. Before taking out the largest possible mortgage, you should consider how those payments and the related property will affect the rest of your financial situation. Bottom line, to determine how much of a VA loan you can afford, you’ll need to speak with a loan officer.

Property insurance is required on all loans secured by property. But unlike conventional refinancing, the IRRL does not require strict background checks on your income. The main qualifications include having a VA-backed home loan or a document that proves you live in or used to live in a house secured by a VA-backed loan. The VA loan program was developed in 1944 as part of the World War II GI Bill, otherwise known as the Servicemen’s Readjustment Act.

The fee is either wrapped into the loan amount or paid in cash at closing. VA loans are mortgages granted to veterans, service members on active duty, members of national guards, reservists, or surviving spouses, guaranteed by the U.S. As long as the person was given a DD 214 document, which proves honorable discharge on good terms, they may qualify. VA loans are intended to help growing populations of homeless veterans in the U.S. find affordable houses. Your monthly expenses include all of the things you regularly have to pay for each month. This can have an impact on how much money you have to commit to your monthly mortgage payments, ultimately affecting how much house you can afford.

According to recent Census Bureau data, Arlington’s median home value is $669,400 and its neighbor Alexandria, is at $557,000. The $274,300 median home value in Virginia Beach seems relatively affordable compared to its neighbors in the north. And if you’re looking for more savings, Richmond comes in at $220,700 - not bad for the state capital. Virginia is the 12th-most populous state in the U.S. with an estimated 8.6 million residents, according to the U.S. The state takes up about 42,800 square miles, and is close in size to Tennessee. The northern and eastern edges of the state hold most of the population.

No comments:

Post a Comment